A manufacturing business operates with complexities in the world of making things, from toys to tools. The manufacturing process needs careful accounting to keep everything running smoothly. This lecture will clarify how to prepare the income statement for a manufacturing company. Some of the benefits of having a Manufacturing account include increased efficiency, improved cash flow, better budgeting, greater flexibility, and the ability to save time and money. A manufacturing business is an enterprise that produces physical goods, either through machines or labor, to sell to customers.

To Ensure One Vote Per Person, Please Include the Following Info

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Kat Cox works to provide answers to the questions small business owners have about how to set up, run, or fund their businesses. FundKite can approve you in as little as 2 business hours for up to $2,000,000 when we are able to obtain your business data and verify your bank account.

Implement Real-Time Inventory Tracking

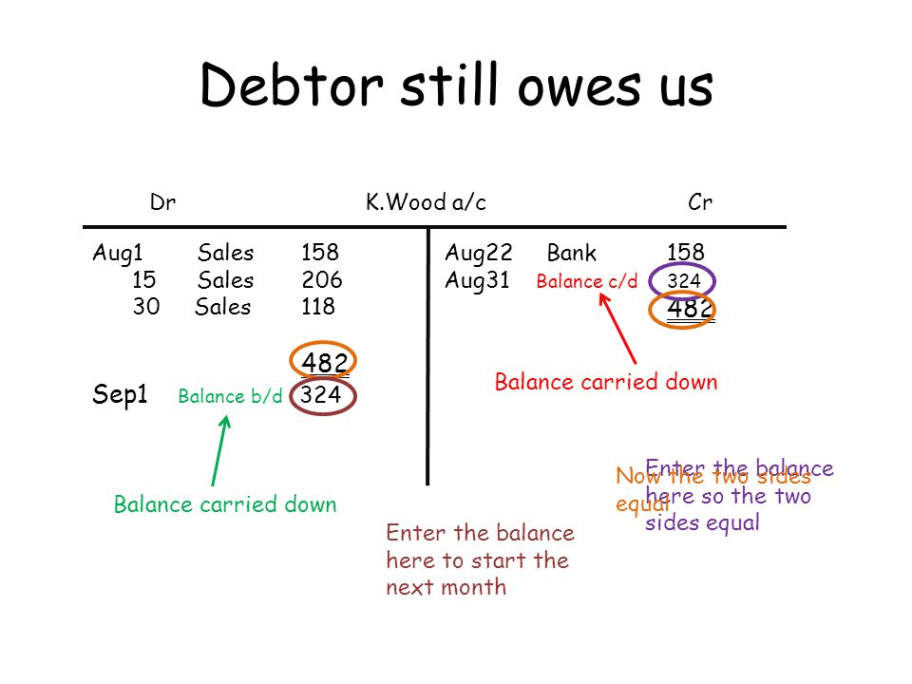

You will need to understand the three common production costing methods we cover below. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. The finished goods Manufacturing account represents all finished products ready for sale. Apply for financing, track your business cashflow, and more with a single lendio account. Inventory is continually being sold and restocked, so you may need to make a cost flow assumption.

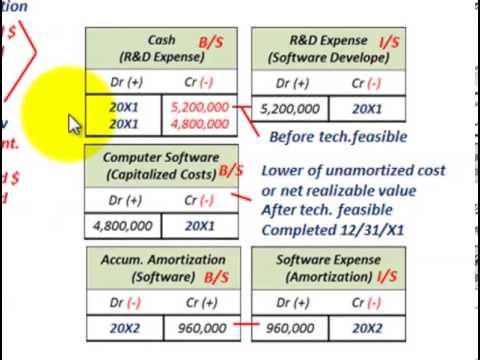

Direct costs

It is a practice first initiated by Toyota but has influenced manufacturing for decades, particularly the automobile industry. Job order costing for manufacturing is desirable for manufacturers who produce customized or variable goods. Each customer might receive unique versions of products using different raw materials or options, so costs are determined for each job order. WAC accounting uses the average cost of all units in inventory and is updated every time a new purchase is made. WAC is easier for manufacturing cost accounting and can smooth out fluctuations in costs or selling prices.

Inventory Cost Flow Equation

Manufacturing accounting follows the same fundamental principles as accounting in other industries, but there are many more moving parts than usual. Let’s look at some general best practices you should follow to optimize https://www.online-accounting.net/ your accounting system. The solution is to build a custom tech stack out of multiple smaller, cheaper, cloud-based systems that integrate to create a synchronised flow of data between each area of your business.

- With a more secure, easy-to-use platform and an average Pro experience of 12 years, there’s no beating Taxfyle.

- You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

- The right accounting solution will also provide easy-to-read financial reports that you can share with tax preparers and accountants.

- You will need to understand the three common production costing methods we cover below.

- Most manufacturers use bills of materials (BOMs) to track the components needed for each product.

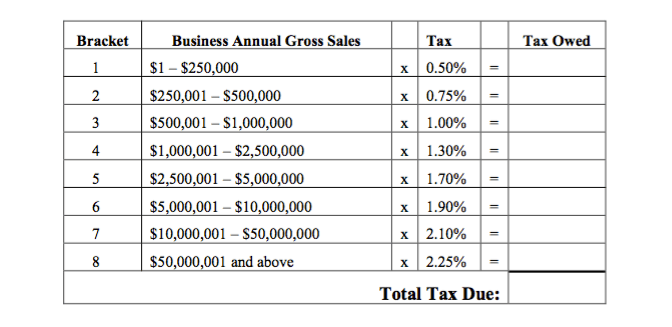

A manufacturing company reports taxes as a separate item in the income statement after the net profit. The amount of taxes is deducted from the net profit to arrive at the bottom https://www.quick-bookkeeping.net/what-is-payback-period/ line, i.E., The net profit after tax. Assume that finished goods are transferred from the factory to the warehouse at production cost plus a 10% manufacturing profit.

Last, but certainly not least, your accounting software should be able to integrate with other systems. It will allow you to calculate costs based on your preferred method so you can optimize business performance. Inventory valuation is assigning a monetary value to your business’s current inventory. Because inventory is considered an asset, this is an essential piece of the accounting process. Cloud-based software will let you do this and will also produce a paper trail if required. With this knowledge you’ll be able to choose the right accounting system to help your manufacturing business grow.

Standard costing is one of the most common production costing methods among manufacturers. It involves calculating a standard rate for groups of costs that go into each unit, including direct materials, direct labor, and manufacturing overhead. In manufacturing accounting, various financial aspects are addressed, including the cost of raw materials, labor, overhead expenses, and inventory valuation. The primary objective is to provide insights into the financial performance and profitability of manufacturing activities, enabling informed decision-making and effective cost management. While keeping production costs to the minimum, businesses need to look to methods that allow them to make the best of their inventory, ensuring they produce quality products while also sustaining seamless cash flow. From inventory and labor expenses to taxes and bookkeeping costs, accounting for manufacturing companies entails several aspects that need to be considered.

Overall, the manufacturing accounting process is much more complex than accounting for most companies that produce no inventory. Having the right manufacturing accounting process can efficiently break down all of the operational costs within your company. Automated bookkeeping tools like a general ledger are also an important benefit of accounting software for any small business. Unlike spreadsheets, accounting software can help you minimize errors from data entry or incorrect formulas. The direct costs are often traceable to the creation of the product and the maintenance of low variability in the overheads allows businesses to ensure a healthy margin of profit. These materials get consumed during production, and the finished goods may need to be inventoried in a warehouse until they can be shipped to a distributor, customer, or elsewhere.

Rootstock has purpose-built features for real-time inventory management for manufacturers. A manufacturer may produce those raw materials internally or purchase them from a supplier, but procuring raw materials chart of accounts (coa) overview is the first step. These are referred to as direct materials and are typically itemized in a streamlined bill of materials. Capturing the cost of manufactured goods requires unique considerations and methods.

Leave A Comment