QuickBooks Online Essentials costs an additional $25 per month, which adds features like bill management and time tracking. Unlike QuickBooks Simple Start, which includes access for one user and their accountant, Essentials allows you to add up to three users (plus your accountant). It has four plans, which means businesses can scale up to plans with more features and users as they grow.

Automatic income and expense tracking

Create, assign, and track projects from start to finish in a single place, on desktop or mobile. Automatically identify and resolve common bookkeeping issues so the books are closed accurately and on time. After any payroll changes you make, QuickBooks will also remind you to check your payroll taxes to see whether the amount you owe has changed. With June comes the official start of summer and the summer solstice—the longest day of the year. It’s a great reminder to soak up a little Vitamin D in the great outdoors. Sign up your clients for Ledger by adding them to QuickBooks Online Accountant.

- According to 81 percent of CBs who interviewed for a new job after becoming certified, having a certification contributed to getting the interview [4].

- You don’t have to pay for more than you need, and you’re not bottlenecked by limited or missing functionality.

- By avoiding this, you’ll reduce the risk of triggering an IRS audit and will allow an accurate picture of your business finances.

- To maintain certification, you need to earn at least 60 continuing education credits every three years.

- Every business step requires capital, from transforming an idea into a model to investing in its expansion.

Best Payroll Software for Accountants

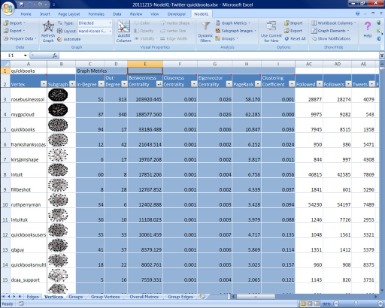

Higher-tiered plans unlock more transactions and a more frequent service level. QuickBooks Online is one of the preeminent cloud-based accounting software platforms on the market. With five plans available, including a plan specifically for self-employed individuals and independent contractors, there are several options from which to choose, depending on your needs. In this guide, we’ll break down QuickBooks Online pricing, including plans, key features, and alternative platform costs so you can decide which option is best for you.

Your financial transactions

We also looked at real customer experiences to determine if their expectations were met based on what each company promised. After assigning a weighted score to each category, we formulated rankings for each company. Bookkeepers offer support to several organizations, including small businesses, nonprofits, and corporations. They are vital to managing a business’s finances by documenting transactions, generating reports, and assisting with accounting efforts.

When an invoice is past due, follow these five steps to collect outstanding payments so you can get paid sooner. Get access to everything from discounts to marketing tools and exclusive training with Pro Advisor. Securely message clients, share documents, and consolidate notes and contact info from a single dashboard.

Accountant Toolbox

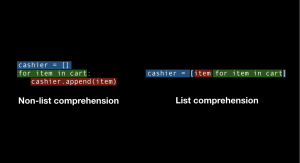

With this method, bookkeepers record transactions under expense or income. Then they create a second entry to classify the transaction on the appropriate account. Without bookkeeping, accountants would be https://www.quick-bookkeeping.net/ unable to successfully provide business owners with the insight they need to make informed financial decisions. Bookkeeping is the process of tracking and recording a business’s financial transactions.

Botkeeper is best for accounting firms that want to scale by automating bookkeeping tasks. Let’s explore what bookkeepers do, some of the benefits of bookkeeping, and your options for using a bookkeeper. Cassie is a deputy editor collaborating with teams around the world while living in the beautiful hills of Kentucky. Prior to joining the team at Forbes Advisor, Cassie was a content operations manager and copywriting manager. You can cancel your QuickBooks Live plan or upgrade from Live Expert Assisted to Live Expert Full-Service Bookkeeping at anytime.

To deliver that promise, you might need to possess skills and expertise including accounting and financial reporting skills, communication skills, and more. While QuickBooks Online is very popular among business owners, some have problems with the system. Problems stem from the complexity of making simple fixes, such as miscategorizations or duplicate entries. Support https://www.business-accounting.net/voided-check-how-to-void-check-for-direct-deposit/ is limited, so users are left reading help articles rather than getting a live person to help. When you sign up for QuickBooks Live Bookkeeping, you are connected with a QuickBooks ProAdvisor, which is a bookkeeper certified by QuickBooks. You can contact your bookkeeper anytime to schedule a live video chat or to discuss questions or concerns about your bookkeeping.

Ongoing communication is available at any time via document sharing and live chat, either with your bookkeeper or a member of your bookkeeper’s team. We believe everyone should be able to make financial decisions with confidence. We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals.

Naturally, QuickBooks Online syncs with other QuickBooks products as well, including QuickBooks Time (formerly TimeTrex), TurboTax and QuickBooks Online Payroll. As part of ongoing bookkeeping, your bookkeeper categorizes your transactions and reconciles your accounts each month. A bookkeeping checklist outlines the tasks and responsibilities trial balance report in sage intacct you need to do regularly to keep the books up-to-date and accurate. It serves as a road map to ensure you correctly record and report all necessary financial transactions are recorded and reported correctly. Bookkeeping is the system of recording, organizing, and tracking financial transactions and information for a business or organization.

If you are a small business or a startup, consider QuickBooks Simple Start. Businesses that provide services, rather than goods, should consider the QuickBooks Essentials plan. Businesses with inventory will likely get the most benefit from QuickBooks Plus. Large businesses that need access for up to 25 users will probably want to go with QuickBooks Advanced.

There is a $500 cleanup fee to get started, which pays to get your books up to date, and then you pay $200 to $400 per month for the service. Because bookkeeping involves the creation of financial reports, you will have access to information that provides accurate indicators of measurable success. By having access to this data, businesses of all sizes and ages can make strategic plans and develop realistic objectives. With these accountant-only tools, you can streamline your work and access customizable reports, so you can advise clients quickly. For additional features, these were elements that fell into the “nice-to-have” category that not all software providers offered, either as part of their regular plan or as a paid add-on. There are different types of bookkeeping services available, depending on the time and money investment you want to make.

Leave A Comment